Some Known Details About Succentrix Business Advisors

Some Known Details About Succentrix Business Advisors

Blog Article

Succentrix Business Advisors - Questions

Table of ContentsThe Basic Principles Of Succentrix Business Advisors About Succentrix Business AdvisorsExamine This Report about Succentrix Business AdvisorsWhat Does Succentrix Business Advisors Mean?How Succentrix Business Advisors can Save You Time, Stress, and Money.

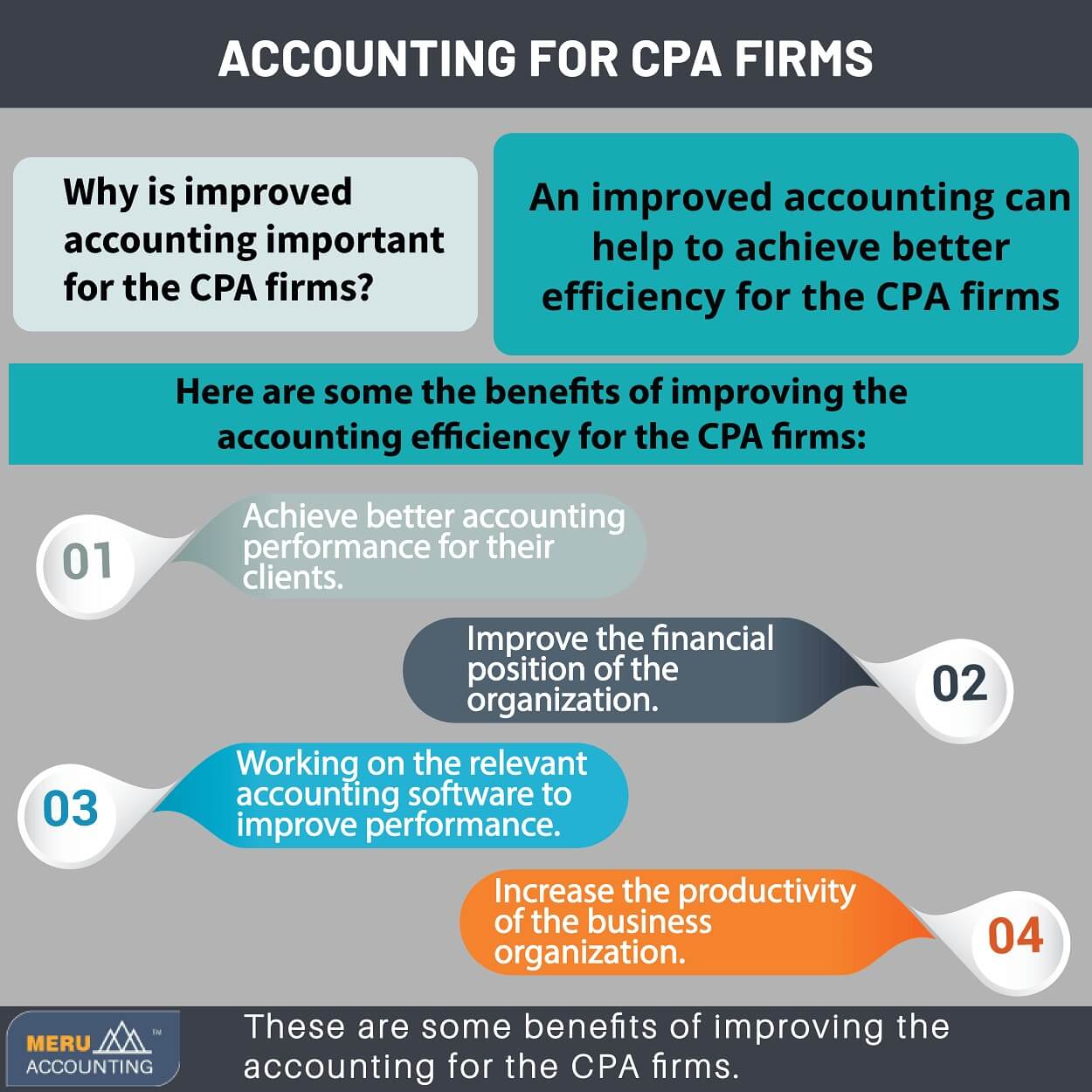

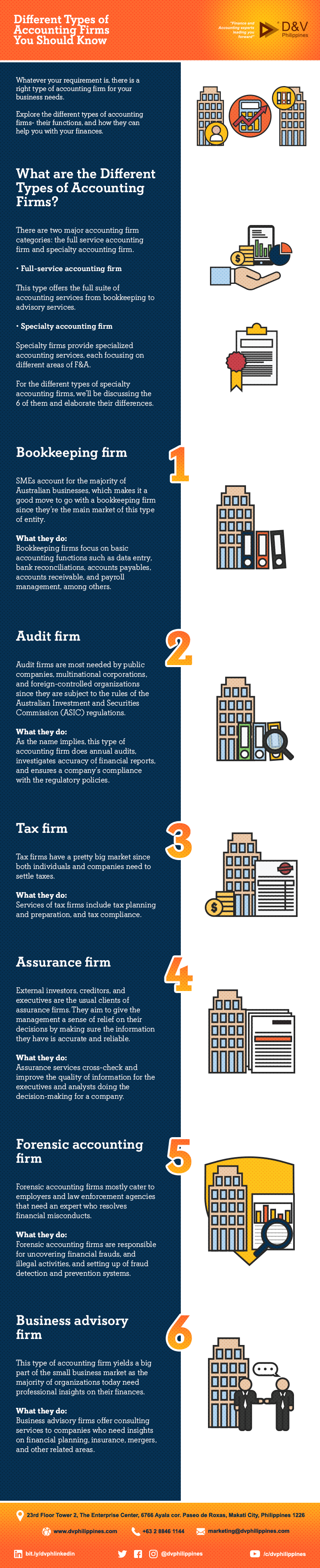

Interior auditing gives administration and the board of supervisors with a value-added service where flaws in a procedure might be captured and dealt with. Tax obligation accountants specialize in preparing tax returns and helping people and organizations submit their types and pay their taxes., so accounting professionals have to stay updated on all of the regulations and regulations.A knowledgeable accounting professional will certainly recognize every tax deduction a person can claim and every credit score they're qualified for. These accounting professionals help individuals maintain their tax obligation expenses low. Forensic bookkeeping has to do with investigation and lawsuits support. This solution is generally involved with claims and accusations of fraud, embezzlement, or money laundering.

The smart Trick of Succentrix Business Advisors That Nobody is Talking About

Accounting is concerning maintaining exact and thorough records. This is the bread and butter of audit. It includes maintaining track of all inputs and results and double-checking every little thing to make sure it's been effectively videotaped.

When it's time to submit for tax obligations or apply for a loan, an accountant can create an economic declaration just by putting with each other the monetary documents for a provided period of time. One of the reasons specialist accounting solutions are so vital is as a result of human error. Any type of process run by people is mosting likely to make mistakes.

That's where bank reconciliation is available in. Financial institution settlement is a procedure of evaluating and comparing - https://pubhtml5.com/homepage/shumv/ your economic records to those of your financial institution and repairing blunders if the documents do not match the method they're meant to. You process repayments and after that down payment those payments in the financial institution. If your documents are exact, your repayment documents should perfectly match the bank's document of down payments.

Some Known Details About Succentrix Business Advisors

Accounts payable is a category that includes future have a peek at this site expenses as well, which aids you plan. If you have a rate of interest payment on an organization car loan due in the next month, you can prepare appropriately to have the cash when you require it. Accounts receivable are all anticipated or set up earnings or resources of revenue.

You may not have the ability to obtain that cash right away, however you can prepare future expenditures based upon the expected in-flows from those receivables. The classification of receivables on a general journal is very important due to the fact that it allows you look in advance and strategy. The even more educated you have to do with your company's financial scenario, the much better ready you are to readjust and adjust as required.

Taking care of a regular pay-roll and records can use up a whole lot of time and initiative, even for a tiny organization without a lot of workers. Accountants deal with companies to arrange and automate pay-roll systems to work better for both companies and employees. Accountancy services concerning pay-roll can entail gathering employee info, developing a time-tracking system, and managing the actual processing of settlements to staff.

The Only Guide for Succentrix Business Advisors

Lots of entrepreneurs collaborate with accounting professionals as they produce business plans, also prior to the service has been developed (Accounting Franchise). Accountants can be useful partners in developing an engaging business plan and discerning which company entity is ideal for the owner's vision. Accountants can help a local business owner pick a company name, collect company details, register for a company recognition number, and register their business with the state

Accountancy solutions have to do with enhancing record processes and generating information to furnish you far better to grow your company and understand your vision.

3 Easy Facts About Succentrix Business Advisors Explained

The fact that many companies consist of the specific same compliance description on customer invoices reinforces that there is second best regarding the compliance report. On the other hand, the suggestions, expertise, planning and strategy that went into the procedure prior to the report was produced are extremely set apart. Advisory solutions expand from our one-of-a-kind experiences and know-how, and are the secret sauce that produces value for our clients.

Advisory sustains expertise, which leads to higher-value solutions and splitting up from the sea of generalists. This is handy, but this interpretation really feels much more official and narrower than just how experts explain advising services in their firms.

Report this page